Simplifying climate

risk with AI.

Purpose built software for investors and advisors

Featured in

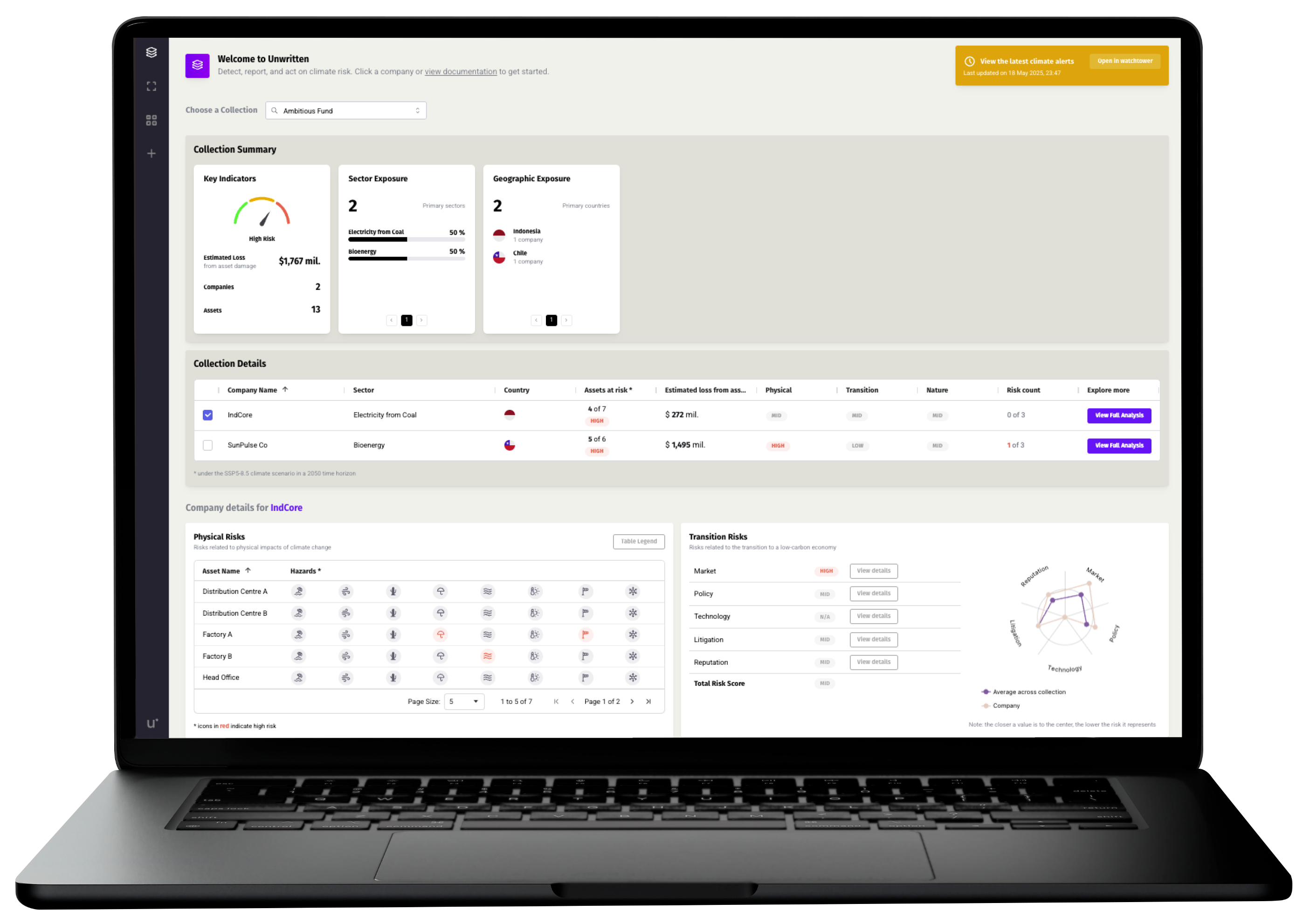

The all-in-one platform for climate risk clarity and confidence.

Empower your organization with climate-risk intelligence built on 1 billion data points.

AI built for climate risk management.

Get tasks done 10x faster—save hours every week with workflows tailored to your industry.

Day-one outcomes

We handle the heavy lifting—upload your data in any format and be up and running in minutes. Our AI intelligently maps your existing data to our climate digital twin.

Ask anything

Our AI-powered platform provides instant answers to your climate risk questions. Extract clear insights from complex data, run custom business logic, and interact with the results with conversation.

AI-Powered outputs

Solve complex problems through conversation—go beyond search and chat to generate custom reports and data exports. For example, quickly build summary reports highlighting key findings for your investment committee.

Why Unwritten?

We're award winning for a reason.

We built the best tool on the market, combining quantitative and qualitative insight across transition, physical, and nature risk—a unified view you won't find anywhere else.

Unrivaled support

Our team plugs into yours—need to ask a question or understand the story behind your results? We've got you covered.

We build at breakneck speed.

We test and ship requested features in days, not years. Stuck waiting for a product feature? Not with us.

Learn more about the industries we work with