PRI Questions for Climate Physical Risk Providers — Answering for Unwritten 360

PRI Questions for Climate Physical Risk Providers — Answering for Unwritten 360

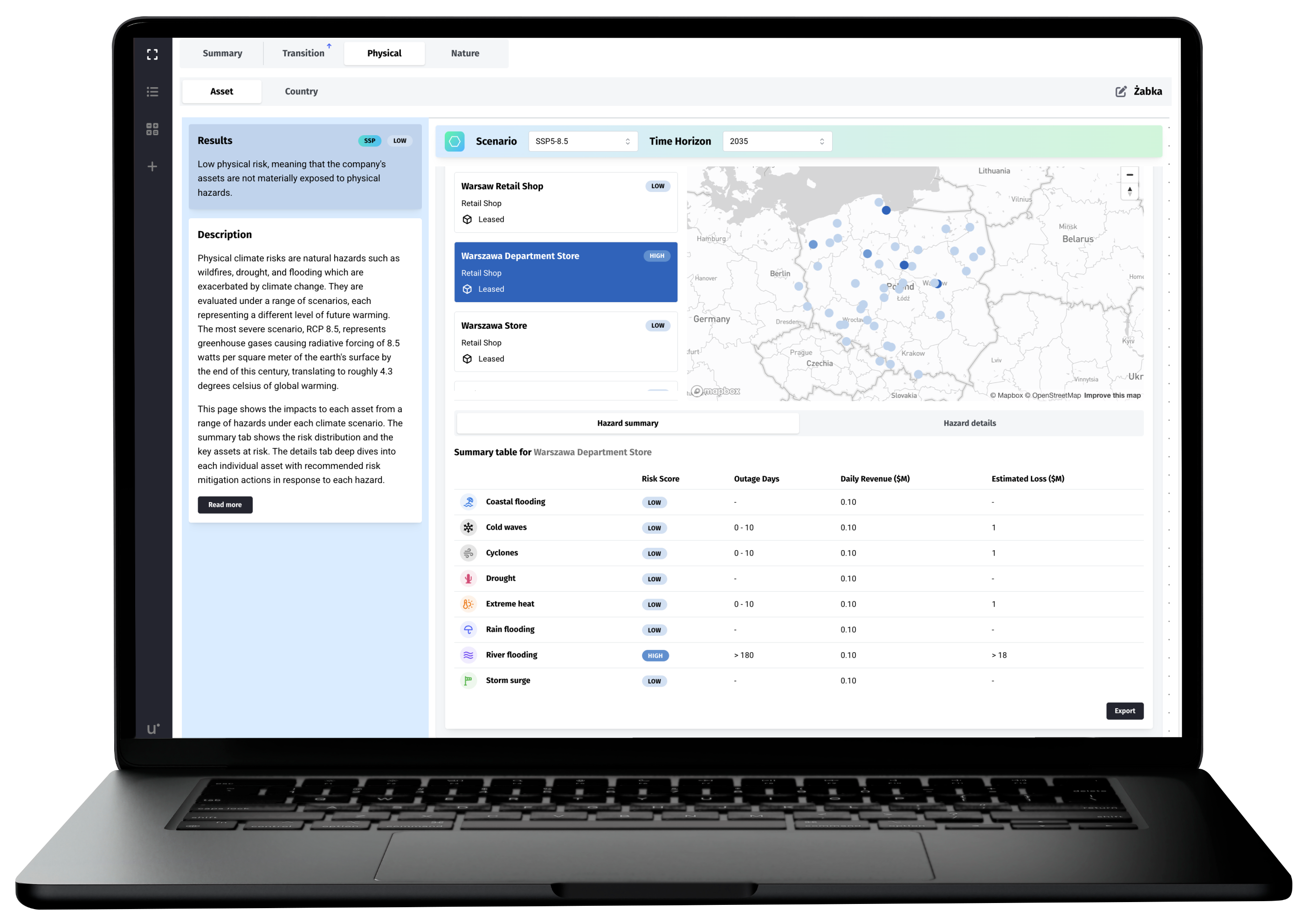

A detailed overview of Unwritten 360's physical climate risk assessment capabilities.

Earlier this year the UN Principles for Responsible Investment (PRI) published a technical guide for private market investors on physical climate risk assessment. The guide came with a list of practical questions to ask providers when procuring a physical risk assessment tool. This article answers each of those questions for Unwritten 360, a leading platform for climate due diligence and risk management in private markets.

The PRI guide focuses explicitly on physical risk, stating: “as the link between physical climate risk and financial impact becomes more evident, climate risk assessment needs to become more sophisticated and embedded within the investment process.”

Our experience working with a wide range of private market investors strongly supports this statement. In fact we go further: we think that physical risks shouldn’t be assessed in isolation. Different categories of climate risk often overlap, so ideally physical risks should be considered alongside exposure to transition and nature related risks. Investors who use Unwritten 360 cite our breadth of coverage as an important reason for choosing the platform over others.

“Different categories of climate risk often overlap, so ideally physical risks should be considered alongside exposure to transition and nature related risks.”

However, the PRI guide is a deep dive on physical risk assessment, and as such, this article focuses exclusively on Unwritten 360's physical risk module.

The guide splits its recommended questions into three sections:

Section 1: “How does the provider support my strategic objectives?”

| Question | Quick Answer | Commentary |

|---|---|---|

1. How can the provider's outputs be integrated into the investment process and strategic business decisionmaking? | Unwritten 360 is built for pre-diligence scans, due diligence, and ongoing risk management. Outputs reflect this:

| This is a double edged question since, to use a tool effectively, investors need a plan for how its outputs will fit into their processes. To put it differently, what specific decisions will the tool help you make? This plan will have a big impact on your specification for the tool. It needs to reflect the limitations of forward looking modelling in general, and of physical climate risk modelling in particular. You can lean on the expertise of preferred providers in the procurement process to develop this plan. |

2. Does the provider offer education to investment teams to ensure they can interpret outputs correctly? | Yes, we offer workshops and training for investment teams as part of the license fee. Training and support for dealmakers, as well as for sustainability professionals, is essential for Unwritten 360 to deliver value. | Like question 1 this places an onus on the sustainability team as well as the tool provider. Expressing results as dollar figures isn't enough to “speak the language” of dealmakers: they need the opportunity to understand how those numbers were calculated, through time, training, and documentation on the underlying data and analytics. |

Section 2: “How do the provider's services and outputs support my physical risk assessment process?”

| Question | Quick Answer | Commentary |

|---|---|---|

1. What types of assets are covered? | Around 60 asset archetypes, covering everything from cold storage warehouses to railways to nursing homes. Linear and area assets are currently supported outside of the platform on request. | Different assets require different modelling approaches. Infrastructure like bridges or ports, for example, will be vulnerable to physical hazards in different ways to real estate or agricultural land. Hazard scoring and financial metrics need to reflect this. To put it another way, the tool should ideally reflect all of the following:

|

2. Are all hazards I want to evaluate covered? Are the hazards they cover material to my specific sectors or industries? | Unwritten 360 covers the following hazards by default: Drought, Wildfire, Cyclone, River flooding, Rain flooding, Coastal flooding, Cold waves, Extreme Heat, Storm surge Additional hazards can be configured on request. In addition, among other vectors, the Nature model covers: Water Scarcity, dependency on Air and Soil Quality. | Almost all physical risk tools will cover flooding, drought, and high winds. Whether or not further coverage is necessary depends on the portfolio being assessed. Land-based hazards such as subsidence are particularly relevant for real estate portfolios, for example; while hazards linked to crop or livestock stress, such as extreme heat, are critical if a portfolio has agricultural exposure. |

3. Does the provider's data cover my geographic area of focus? | Unwritten 360 has global, high resolution coverage of physical risks. Like all tools, there are variations in resolution between hazards (e.g., the resolution for cyclones is lower than for flooding, since cyclones tend to affect larger areas indiscriminately). There are also variations in resolution in different parts of the world. | Most solutions offered to Private Equity buyers will have global coverage. However, there can be big discrepancies in resolution between regions. For portfolios with high geographic concentration, specialist providers might be worth considering. (For example, if granular flood mapping of a particular city is needed for a concentrated real estate portfolio, incorporating the most up-to-date coverage of that city's flood defences.) Another option is to rely on mainstream providers for initial triage, and then to procure specialist data and expertise for deep dives into locations with high materiality risks. |

4. Does the selection of climate scenarios align with my strategic objectives, reporting, and risk assessment needs? | Unwritten 360 uses the industry standard three IPCC Scenarios by default: SSP1 - 2.6, SSP2 - 4.5 and SSP5 - 8.5. The default time horizons are 2035 and 2050, with more available on request. Return periods can also be customised. The transition risk module includes Net Zero 2050, Below 2C, Delayed Transition, and NDCs scenarios, as well as infinitely customisable custom scenarios for carbon price. | TCFD guidance is to consider physical risks under three scenarios. Most tools offer RCPs 2.6, 4.5, and 8.5 as standard. These represent different trajectories of greenhouse gas concentrations in the atmosphere, leading to varying degrees of global warming. RCP 2.6 assumes strong reductions in emissions, RCP 4.5 assumes moderate reductions, and RCP 8.5 represents a “worst case” high warming scenario (although this is a linear worst case, which does not take account of tipping points that could cause very severe warming). This meets the requirements for all IFRS S2- and TCFD-aligned climate risk disclosure regimes. |

5. Does the provider use open-source, private or proprietary data, or a combination? | A combination. | All commercial tool providers rely on a combination of data sources. The underlying frameworks for physical risk analysis, such as the RCPs mentioned above, rely on open, internationally agreed standards. So tools take these as a foundation and build out proprietary value by layering sources and models together, building them into platforms that enable particular workflows (e.g., due diligence or reporting), and extending them with advanced quantification models. |

6. Does the provider offer transparent information about the underlying climate models and methodologies and the frequency of updates? Is the data of high quality and the appropriate granularity? | Yes, all of the data and models in Unwritten 360 are transparently documented. Product development roadmaps are available to all customers, and full release notes are provided when models are updated. Prospective customers can access complete information about the provenance and granularity of our models to ensure they meet requirements. | Having access to underlying model information is critical for interpreting and validating results. It is rare to see commercial tools with models that are totally undocumented, but the quality and granularity of documentation varies widely. It is also worth gauging the level of technical support offered by a provider to help make sense of model methodologies — especially if the topic of climate risk is relatively new to the firm. |

7. Does the provider have the capabilities to assess linear assets, if applicable? If so, how does it conduct these assessments? | Unwritten 360 supports the modelling of linear and area (shape) assets outside of Unwritten 360. Assets can be shared in different file formats and results are returned as data tables. Alternatively, users can self-serve via direct access to a platform from one of our modelling partners for no extra cost. | The risks to an asset covering a large area, such as agricultural land or roads and railways, will vary significantly at different points. It's important to sample risk to the whole of the asset and identify any hotspots. For solutions that do not support linear / shape upload, users can still conduct a relatively effective assessment by translating the overall area into a number of points, ideally covering points of variation in exposure (areas closer to forests, rivers, coastline, etc.). |

8. Does the provider's risk assessment methodology include consideration of vulnerability data? If so, how? | Unwritten 360 considers vulnerability data in several ways:

| As commented on Answer 1, a tool should ideally reflect the vulnerability of an asset as well as the likelihood of a particular hazard. Vulnerability captures an asset's sensitivity to harm, its adaptive capacity, and its ability to respond and recover from a given climate hazard. In a Private Equity context, other factors will also be relevant: the nature of the investment, the business model of the asset, the presence and cost of insurance, and so on. No tool can fully capture all of these variables, but basic consideration is helpful for effectively triaging risks and deciding which ones to deep dive on. |

9. Does the provider's risk assessment methodology take into account non-physical damage impacts of climate events? If so, how? | Yes, Unwritten 360's methodology looks at business interruption in terms of outage days. For example, our flood scores for Office assets consider that flooding in the near vicinity of an office will hinder people's ability to get to work, even if the office itself is undamaged. The Live Risk tracker, Watchtower, tracks non physical damage effects in real time, such as power cuts caused by high wind. Lastly, the platform's transition and nature modules provide extensive detail on policy and legal responses to climate change. | The disruption caused by climate events almost always extends beyond direct damage. Impacts like loss of power, limited site access, worker welfare, and increases in insurance premiums can have a crippling effect on businesses, even if they suffer no direct physical damage to assets. Good climate risk assessments are cognizant of these non-physical impacts—particularly for assets with concentrated revenue exposure such as specialised factory sites. |

Section 3: “What outputs, including financial metrics, does the provider generate?”

| Question | Quick Answer | Commentary |

|---|---|---|

1. What financial metrics are generated, and what are the assumptions behind the calculation of those metrics? Can the underlying data/assumptions be supplied separately so that they can be plugged directly into our own financial/risk assessment models? | Unwritten 360 calculates potential revenue loss for every hazard to each asset. These metrics are also provided in aggregate at company, fund, and firm level. Revenue loss is based on modelled outage days; which are a function of the hazard type, asset archetype, and hazard severity. For example, 10 outage days caused by flooding at a solar farm generating $100,000 a day would mean a revenue loss of $1M. The underlying hazard data (e.g., metres of river inundation, consecutive days of drought, etc.) is supplied separately, as are the outage day bands. All relevant assumptions and parameters, such as scenario, time horizon, and return period, are also surfaced. | Financial metrics can be extremely valuable for translating risk into materiality. For example, a low risk to a factory that is critical to a company's manufacturing process might be much more material than a high risk to a small distribution site. There are two broad categories of financial metrics: asset damage and revenue loss. Unwritten 360 is designed for businesses and business owners, so we chose revenue loss as our primary financial metric. We believe it is more representative than asset damage of the business impact of a given hazard. Regardless of the metric, it is important to understand that translating hazard data into financial damage involves introducing several additional assumptions to the model. As such, financial metrics should be used with appropriate caution. |

2. How are risk scores defined and calculated? | Risk score methodology differs for each hazard and is documented in full within the platform. | The simplicity of RAG / High Medium / Low risk scores is appealing, but the methodology for arriving at these categorisations can vary widely between providers. (E.g., one methodology might say that any flooding to an asset makes it High risk, where another might reserve that categorisation for severe inundation only.) It is also important to understand whether risk scoring varies by archetype. The same level and probability of flooding could have very different implications for an office versus an agricultural site, for example. |

3. Will the outputs support my reporting and disclosure requirements? (For example, LP reporting and/or ISSB disclosures.) | Unwritten 360 has a dedicated reporting module based on our review of hundreds of ISSB disclosures and extensive client insight into LP reporting requirements. Unwritten publishes key takeaways from our review of ISSB disclosures each year in our annual disclosure benchmarking report. | Most climate risk disclosure rules enforced by regulators follow the same basic framework, originally created by the TCFD and now overseen by the ISSB. However, there can be important differences between implementations of this framework — for example, the California SB 261 rule requires disclosers to include mitigating actions for physical risks. Unwritten offers free templates for disclosures in different jurisdictions, which you can access here. |

Section 1: “How does the provider support my strategic objectives?”

1. How can the provider’s outputs be integrated into the investment process and strategic business decisionmaking?

Unwritten 360 is built for pre-diligence scans, due diligence, and ongoing risk management. Outputs reflect this:

- RAG scoring for quick triage

- Detailed hazard data with financial materiality assessment for diligence

- Impact- and cost-assessed mitigation strategies, as well as live risk monitoring, for ongoing management.

This is a double edged question since, to use a tool effectively, investors need a plan for how its outputs will fit into their processes. To put it differently, what specific decisions will the tool help you make? This plan will have a big impact on your specification for the tool. It needs to reflect the limitations of forward looking modelling in general, and of physical climate risk modelling in particular. You can lean on the expertise of preferred providers in the procurement process to develop this plan.

2. Does the provider offer education to investment teams to ensure they can interpret outputs correctly?

Yes, we offer workshops and training for investment teams as part of the license fee. Training and support for dealmakers, as well as for sustainability professionals, is essential for Unwritten 360 to deliver value.

Like question 1 this places an onus on the sustainability team as well as the tool provider. Expressing results as dollar figures isn't enough to “speak the language” of dealmakers: they need the opportunity to understand how those numbers were calculated, through time, training, and documentation on the underlying data and analytics.

Section 2: “How do the provider's services and outputs support my physical risk assessment process?”

1. What types of assets are covered?

Around 60 asset archetypes, covering everything from cold storage warehouses to railways to nursing homes.

Linear and area assets are currently supported outside of the platform on request.

Different assets require different modelling approaches. Infrastructure like bridges or ports, for example, will be vulnerable to physical hazards in different ways to real estate or agricultural land. Hazard scoring and financial metrics need to reflect this.

To put it another way, the tool should ideally reflect all of the following:

- Hazard (e.g., wildfire or flood) intensity

- Hazard likelihood

- Exposure (i.e., the location of the asset)

- Vulnerability (the severity of impact the hazard has on the particular type of asset

2. Are all hazards I want to evaluate covered? Are the hazards they cover material to my specific sectors or industries?

Unwritten 360 covers the following hazards by default: Drought, Wildfire, Cyclone, River flooding, Rain flooding, Coastal flooding, Cold waves, Extreme Heat, Storm surge Additional hazards can be configured on request.

In addition, among other vectors, the Nature model covers: Water Scarcity, dependency on Air and Soil Quality.

Almost all physical risk tools will cover flooding, drought, and high winds. Whether or not further coverage is necessary depends on the portfolio being assessed.

Land-based hazards such as subsidence are particularly relevant for real estate portfolios, for example; while hazards linked to crop or livestock stress, such as extreme heat, are critical if a portfolio has agricultural exposure.

3. Does the provider's data cover my geographic area of focus?

Unwritten 360 has global, high resolution coverage of physical risks.

Like all tools, there are variations in resolution between hazards (e.g., the resolution for cyclones is lower than for flooding, since cyclones tend to affect larger areas indiscriminately). There are also variations in resolution in different parts of the world.

Most solutions offered to Private Equity buyers will have global coverage. However, there can be big discrepancies in resolution between regions.

For portfolios with high geographic concentration, specialist providers might be worth considering. (For example, if granular flood mapping of a particular city is needed for a concentrated real estate portfolio, incorporating the most up-to-date coverage of that city's flood defences.)

Another option is to rely on mainstream providers for initial triage, and then to procure specialist data and expertise for deep dives into locations with high materiality risks.

4. Does the selection of climate scenarios align with my strategic objectives, reporting, and risk assessment needs?

Unwritten 360 uses the industry standard three IPCC Scenarios by default: SSP1 - 2.6, SSP2 - 4.5 and SSP5 - 8.5.

The default time horizons are 2035 and 2050, with more available on request. Return periods can also be customised.

The transition risk module includes Net Zero 2050, Below 2C, Delayed Transition, and NDCs scenarios, as well as infinitely customisable custom scenarios for carbon price.

TCFD guidance is to consider physical risks under three scenarios. Most tools offer RCPs 2.6, 4.5, and 8.5 as standard. These represent different trajectories of greenhouse gas concentrations in the atmosphere, leading to varying degrees of global warming. RCP 2.6 assumes strong reductions in emissions, RCP 4.5 assumes moderate reductions, and RCP 8.5 represents a “worst case” high warming scenario (although this is a linear worst case, which does not take account of tipping points that could cause very severe warming).

This meets the requirements for all IFRS S2- and TCFD-aligned climate risk disclosure regimes.

5. Does the provider use open-source, private or proprietary data, or a combination?

A combination.

All commercial tool providers rely on a combination of data sources. The underlying frameworks for physical risk analysis, such as the RCPs mentioned above, rely on open, internationally agreed standards. So tools take these as a foundation and build out proprietary value by layering sources and models together, building them into platforms that enable particular workflows (e.g., due diligence or reporting), and extending them with advanced quantification models.

6. Does the provider offer transparent information about the underlying climate models and methodologies and the frequency of updates? Is the data of high quality and the appropriate granularity?

Yes, all of the data and models in Unwritten 360 are transparently documented. Product development roadmaps are available to all customers, and full release notes are provided when models are updated.

Prospective customers can access complete information about the provenance and granularity of our models to ensure they meet requirements.

Having access to underlying model information is critical for interpreting and validating results. It is rare to see commercial tools with models that are totally undocumented, but the quality and granularity of documentation varies widely. It is also worth gauging the level of technical support offered by a provider to help make sense of model methodologies — especially if the topic of climate risk is relatively new to the firm.

7. Does the provider have the capabilities to assess linear assets, if applicable? If so, how does it conduct these assessments?

Unwritten 360 supports the modelling of linear and area (shape) assets outside of Unwritten 360. Assets can be shared in different file formats and results are returned as data tables. Alternatively, users can self-serve via direct access to a platform from one of our modelling partners for no extra cost.

The risks to an asset covering a large area, such as agricultural land or roads and railways, will vary significantly at different points. It's important to sample risk to the whole of the asset and identify any hotspots.

For solutions that do not support linear / shape upload, users can still conduct a relatively effective assessment by translating the overall area into a number of points, ideally covering points of variation in exposure (areas closer to forests, rivers, coastline, etc.).

8. Does the provider's risk assessment methodology include consideration of vulnerability data? If so, how?

Unwritten 360 considers vulnerability data in several ways:

- A wide range of asset archetypes, reflecting the very different vulnerabilities of different kinds of asset (see Answer 1 in this section)

- The ability to toggle defended versus undefended risk for various hazards

- The ability to record whether or not a particular asset has mitigation measures in place

- Suggested mitigation actions for each hazard to every asset, each of which is cost- and impact-assessed

As commented on Answer 1, a tool should ideally reflect the vulnerability of an asset as well as the likelihood of a particular hazard.

Vulnerability captures an asset's sensitivity to harm, its adaptive capacity, and its ability to respond and recover from a given climate hazard. In a Private Equity context, other factors will also be relevant: the nature of the investment, the business model of the asset, the presence and cost of insurance, and so on.

No tool can fully capture all of these variables, but basic consideration is helpful for effectively triaging risks and deciding which ones to deep dive on.

9. Does the provider's risk assessment methodology take into account non-physical damage impacts of climate events? If so, how?

Yes, Unwritten 360's methodology looks at business interruption in terms of outage days. For example, our flood scores for Office assets consider that flooding in the near vicinity of an office will hinder people's ability to get to work, even if the office itself is undamaged.

The Live Risk tracker, Watchtower, tracks non physical damage effects in real time, such as power cuts caused by high wind.

Lastly, the platform's transition and nature modules provide extensive detail on policy and legal responses to climate change.

The disruption caused by climate events almost always extends beyond direct damage. Impacts like loss of power, limited site access, worker welfare, and increases in insurance premiums can have a crippling effect on businesses, even if they suffer no direct physical damage to assets.

Good climate risk assessments are cognizant of these non-physical impacts—particularly for assets with concentrated revenue exposure such as specialised factory sites.

Section 3: “What outputs, including financial metrics, does the provider generate?”

1. What financial metrics are generated, and what are the assumptions behind the calculation of those metrics? Can the underlying data/assumptions be supplied separately so that they can be plugged directly into our own financial/risk assessment models?

Unwritten 360 calculates potential revenue loss for every hazard to each asset.

These metrics are also provided in aggregate at company, fund, and firm level.

Revenue loss is based on modelled outage days; which are a function of the hazard type, asset archetype, and hazard severity.

For example, 10 outage days caused by flooding at a solar farm generating $100,000 a day would mean a revenue loss of $1M.

The underlying hazard data (e.g., metres of river inundation, consecutive days of drought, etc.) is supplied separately, as are the outage day bands. All relevant assumptions and parameters, such as scenario, time horizon, and return period, are also surfaced.

Financial metrics can be extremely valuable for translating risk into materiality. For example, a low risk to a factory that is critical to a company's manufacturing process might be much more material than a high risk to a small distribution site.

There are two broad categories of financial metrics: asset damage and revenue loss.

Unwritten 360 is designed for businesses and business owners, so we chose revenue loss as our primary financial metric. We believe it is more representative than asset damage of the business impact of a given hazard.

Regardless of the metric, it is important to understand that translating hazard data into financial damage involves introducing several additional assumptions to the model. As such, financial metrics should be used with appropriate caution.

2. How are risk scores defined and calculated?

Risk score methodology differs for each hazard and is documented in full within the platform.

The simplicity of RAG / High Medium / Low risk scores is appealing, but the methodology for arriving at these categorisations can vary widely between providers. (E.g., one methodology might say that any flooding to an asset makes it High risk, where another might reserve that categorisation for severe inundation only.)

It is also important to understand whether risk scoring varies by archetype. The same level and probability of flooding could have very different implications for an office versus an agricultural site, for example.

3. Will the outputs support my reporting and disclosure requirements? (For example, LP reporting and/or ISSB disclosures.)

Unwritten 360 has a dedicated reporting module based on our review of hundreds of ISSB disclosures and extensive client insight into LP reporting requirements.

Unwritten publishes key takeaways from our review of ISSB disclosures each year in our annual disclosure benchmarking report.

Unwritten offers free templates for disclosures in different jurisdictions, which you can access here.

You can find the full guide here — it's an extremely valuable resource. The provider selection questions can be found on page 19.

To learn more about Unwritten 360 for private markets investors, click here.